a new high or low will change the reversal price and the midpoint

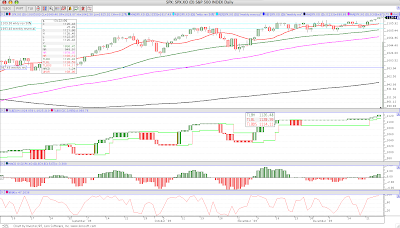

SPX -no change

trend=up

rev= 1093.48; mid= 1109.98

monthly info new high

trend=up; rev= 1020.62; mid= 1067.86

Chart of SPX:

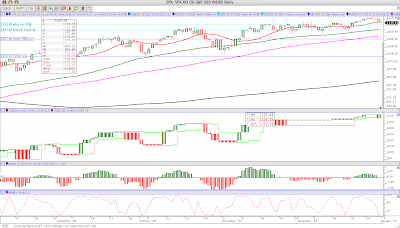

Dow Jones -no change

trend=up

rev= 10318.16; mid= 10419.13

monthly new high

trend=up; rev= 9712.28; mid= 10070.17

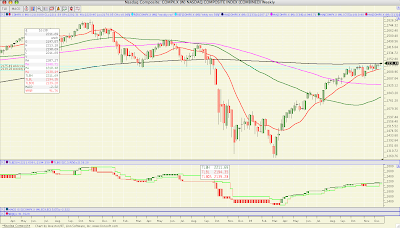

Nasdaq Comp -no change (still above weekly 233sma)

trend=up

rev= 2167.88; mid= 2226.79

monthly info new high

trend=up; rev= 2009.06; mid= 2139.11

Chart of Nasdaq Comp:

DXY -new high

trend=up;

rev= 75.75; mid= 76.81

monthly info -no change

trend=down; rev= 78.15; mid=76.52

Chart of DXY:

Gold -no change

trend=up

rev= 1095.70; mid= 1134.95

monthly info -no change

trend=up; rev= 978.80; mid= 1079.95

Chart of Gold:

10 Year -no change (almost had a reversal)

trend=no; direction=down (2 bars)

rev= 38.62; mid= 35.37

30 Year -no change (bearish thrusting candle so yield should keep increasing)

trend=no; direction=up (1 bar)

rev= 40.11; mid= 43.49

SLV -no change (sitting just above reversal...warning)

trend=up

rev= 16.50; mid= 17.36

BAC -no change (trading below mid...again and again and again and again)

trend=down

rev= 17.46; mid= 16.02

AXP -no change

trend=up

rev= 37.21; mid= 39.45

AMZN -no change (ALMOST a dark cloud but it's a bearish thrusting candle)

trend=up

rev= 126.20; mid= 132.34

M -no change (had a weekly reversal but still needs confirmation week. Still not confirmed after 4 weeks)

trend=no; direction=down (1 bar)

rev= 19.82; mid= 17.90

VIX -no change (trading above trend line)

trend=no; direction=down (2 bars)

rev= 30.69; mid= 25.08

Chart of VIX:

XLF -no change (trading above mid now)

trend=no; direction=down (1 bar for 9 weeks)

rev= 15.24; mid=14.65

BKX -no change (still trading below mid)

trend=no; direction=down (1 bar for 9 weeks)

rev= 47.69, mid= 44.96

WTI Crude Oil -no change (Bullish piercing on candle 2 weeks ago. confirmed last week. closed higher this week)

trend=up

rev= 68.44; mid= 74.47

Chart of WTI:

Powershares USD Bull (UUP) -new high

trend=up

rev=22.32; mid=22.70

Chart of UUP:

Goldman Sachs -no change

trend=no; direction=down (2 bars)

rev= 189.30; mid= 176.10

TLT -no change (possible morning star on weekly candle)

trend=no; direction=down (1 bar)

rev= 99.01; mid= 94.36

Chart of TLT:

Apple Computer -new high (possible evening star. getting congested)

trend=up

rev= 203.94; mid= 207.34

Chart of AAPL:

Sugar #11 -no change

trend=up

rev= 23.91; mid= 25.50

monthly info -new high

trend=up; rev= 16.81; mid= 21.88

Chart of Sugar #11: